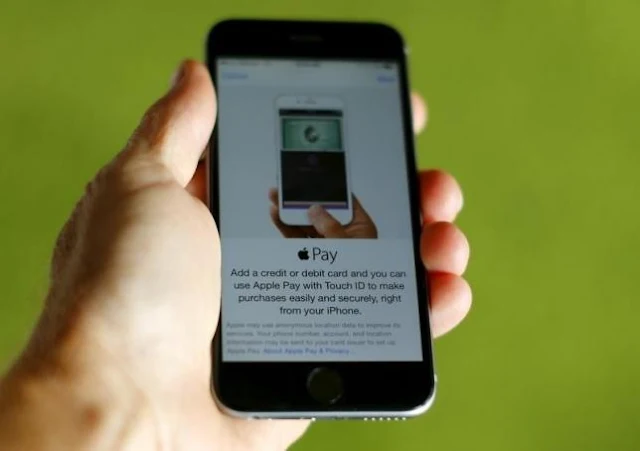

Now you can send and receive money with Apple Pay Cash in Messages or just by asking Siri. There is no app needed to be downloaded and the cards that you have already in Wallet can be used to make payments in stores, in apps or simply anywhere across the web. Right from sending money to your child in college or paying your bills to paying a babysitter, you can send and receive payments from across the table or even from across the country in an instant with the help of Apple Pay Cash.

There are some pre-requisites to make or receive payments with Apple Pay. You need to be a resident of the United States and must be at least 18 years old. In addition you also need the following:

When you receive money from someone, it is safely kept on your Apple Pay Cash card by default. You will be able to see the new addition of your Apple Pay Cash card in Wallet and you can use it for your personal transactions or transferring some amount to your own bank account from your Apple Pay Cash.

While setting up for the first time, you need to use any device supporting Apple Pay Cash when you’re signed into iCloud with the help of your Apple ID. Thereafter, you need to tap on Settings and then on Wallet & Apple Pay. After this, you need to tap on the Apple Pay Cash card and then follow the instructions that appear on the screen. If Apple Pay Cash is turned off on any one particular device, other devices can still be used to access Apple Pay Cash by signing in with your Apple ID.

No fee is charged to use Apple Pay Cash with a debit card. However, using a credit card will cost you a 3% credit card fee on the amount. Your credit remains unaffected on setting up Apple Pay Cash. At certain points, you will be asked to verify your identity while using Apple Pay Cash for security reasons. Failing to comply with this step will result in reduced functionality of Apple Pay Cash.

There are some pre-requisites to make or receive payments with Apple Pay. You need to be a resident of the United States and must be at least 18 years old. In addition you also need the following:

- A device that is compatible with iOS 11.2 or later.

- An authentication for your Apple ID that is two-factor. You have to make sure that with the help of your Apple ID you sign in to iCloud on any device that you want to utilise for sending or receiving money.

- You also need to have an eligible credit or debit card in your Wallet, to be able to send money.

Setting up Apple Pay Cash in Wallet

When you receive money from someone, it is safely kept on your Apple Pay Cash card by default. You will be able to see the new addition of your Apple Pay Cash card in Wallet and you can use it for your personal transactions or transferring some amount to your own bank account from your Apple Pay Cash.

While setting up for the first time, you need to use any device supporting Apple Pay Cash when you’re signed into iCloud with the help of your Apple ID. Thereafter, you need to tap on Settings and then on Wallet & Apple Pay. After this, you need to tap on the Apple Pay Cash card and then follow the instructions that appear on the screen. If Apple Pay Cash is turned off on any one particular device, other devices can still be used to access Apple Pay Cash by signing in with your Apple ID.

No fee is charged to use Apple Pay Cash with a debit card. However, using a credit card will cost you a 3% credit card fee on the amount. Your credit remains unaffected on setting up Apple Pay Cash. At certain points, you will be asked to verify your identity while using Apple Pay Cash for security reasons. Failing to comply with this step will result in reduced functionality of Apple Pay Cash.